Paycent Debit Card Review

Paycent is one of many companies that are beginning to successfully address one of the most pressing issues in cryptocurrency. How do users easily manage their tokens and spend them for physical goods? Paycent has created a platform which includes the ability to convert digital tokens in to fiat currencies. Paycent cards allow users to withdraw fiat from ATMs, and the best part about it is that the company is making its crypto cards available globally.

About Paycent: Paycent.com

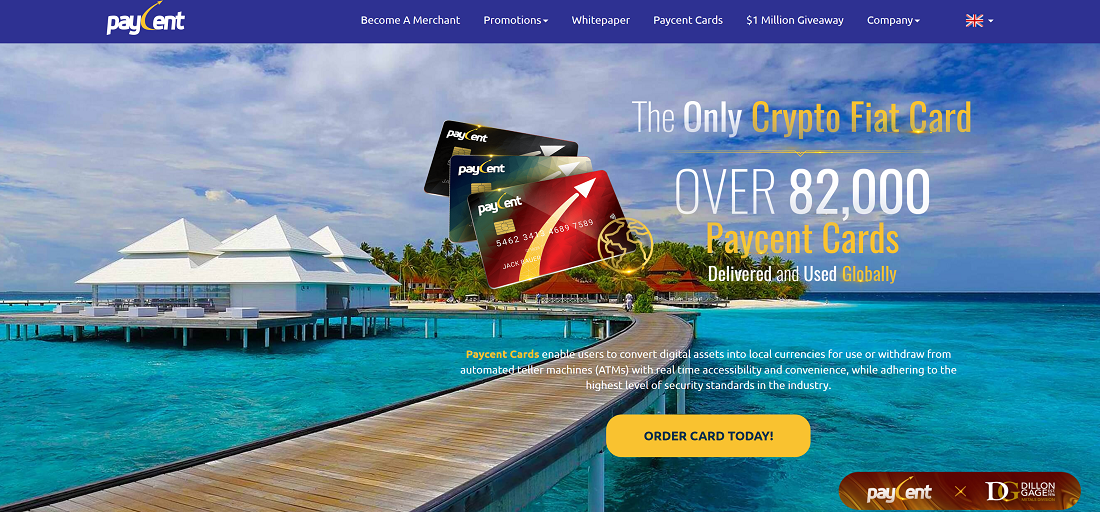

The first thing one notices when visiting the Paycent website is the attractive and professional design. Right away that says something about the company. It is not unusual to see other cryptocurrency debit cards promoted with a website that has been thrown together with little regard for spelling errors, an overall lack of reliable information, or information on the company.

On the About Us page of the Paycent website we were able to determine that the company was founded in Singapore as a subsidiary of Texcent. Paycent specializes in delivering fully integrated mobile applications. The company is licensed by the Monetary Authority of Singapore and holds membership in the Singapore Fintech Association. Its other offices are located in the Philippines and UAE.

Paycent is somewhat unique among cryptocurrency debit cards in that it has its own digital token. The PYN cryptocurrency was created to integrate with the Paycent platform and even allow users to earn rewards, but more about that a little later. Let’s take a look at some of the features of Paycent.

Paycent Card Features

The Paycent platform is delivered as an app for Android and iOS devices. It is available to download in Google Play or the App Store. Within just a few moments you can have the app installed on your device and ready to use. The app is what allows you to order the world’s first truly global cryptocurrency debit card.

Paycent has confirmed to us that they offer the following cryptocurrency debit cards:

- China Union Pay

- Union Pay International

- MasterCard

All of these cards can be used globally for ATM withdrawals and POS transactions. The Union Pay International card and MasterCard can also be used to purchase goods online. The cards are identified by Paycent in the following manner:

- Paycent Ruby Card – For China UnionPay

- Paycent Sapphire Card – For UnionPay International

- Paycent Solitaire Card – For MasterCard

Paycent also provides users with a digital cryptocurrency wallet that is compatible with many different tokens. Users can receive crypto to their Paycent wallet and from there transfer it to what is called the Paycent SIP wallet which is used for card funding.

Users can also use the funds from their SIP wallet to pay for the delivery of the card. Notice that we said pay for delivery. That’s right. At the present time there is no charge for the card itself. Users only have to cover the courier fee that is charged by DHL or FedEx for delivery.

How Paycent Cryptocurrency Debit Cards Work

The process for using a Paycent cryptocurrency debit card is simple and straightforward. Users begin by ordering a card from the app once they have established and verified their account. The next step is to get funds in the Paycent SIP wallet. A user can select CASH IN and use a Visa or MasterCard to put money in the SIP wallet. Once the wallet has been loaded the user just taps ORDER CARD to order the correct card for their location and pay the shipping fee.

Again, it should be noted that you are not paying for the card itself. You are only paying the shipping fee. For the time being the cards are free to order. It is also possible to receive cryptocurrencies in your Paycent digital crypto wallet, sweep those to the SIP wallet, and order the card.

Account verification requires a photo ID, a recent utility bill, and a selfie with the ID.

Once your card has been loaded and funded you are able to use it globally at ATMs to withdraw cash, and you can also use it at physical merchants to buy goods. Some varieties of the card can also be used for online purchases.

If the above sounds a bit confusing, it is. One of our minor complaints with the card is that the whole moving money process could be simplified. We expect that it will be in the future as the company continues to develop its platform. Overall, though, this is one of the easiest ways to access and spend your cryptocurrency.

Paycent Fees

We’re not going to try and avoid this issue in our review. The fee structure of Paycent seems a little complex. Rather than try to explain every individual fee we have provided screenshots right from the Paycent website below. The below fees apply to the Paycent MasterCard. Fees for the other cards are comparable.

As you can see, there is a $49 USD delivery charge for the card. There is also a monthly fee of $2.00 if you have less than $1,000 in transactions. A fee of 1.5% is charged for loading the card, and there is also a KYC Approval Fee of $2.00. We don’t really understand charging you for the company’s need to remain in compliance with Know Your Customer regulations. This is not something we have seen other cryptocurrency debit cards do, but the others also charge for their cards. So, it’s something of a push.

The fees for withdrawing money at an ATM are reasonable and competitive, and there is also a $0.20 transaction fee for both POS and retail transactions. That can add up over time if you use the card a lot. The most up to date fees can be seen here : https://paycent.com/paycent-card/

Paycent Service and Support

At the present time users may contact Paycent support by emailing them at [email protected]

Paycent is also available on social media with accounts at the following addresses:

Twitter: https://twitter.com/paycentglobal/

Facebook: https://www.facebook.com/paycent.sg/

Linkedin: https://www.linkedin.com/showcase/paycentos/

Our View of Paycent

Paycent may not be a perfect answer when it comes to easily spending your crypto, but it could be the best answer. We have not been able to find any other cryptocurrency card provider that issues cards that will work globally. In this aspect, Paycent stands alone.

There is also a reward program offered which will allow users to earn the company’s token, PYN. It seems that Paycent is encouraging users to HODL to the token and is willing to reward them for doing so. At the present the token is only supported on some of the minor cryptocurrency exchanges.

When the positives and negatives are all balanced out, we find that Paycent is a promising venture for cryptocurrency debit cards. The company seems to be off to a good start, and global access wins us over.

Paycent Pros

- First truly global cryptocurrency debit card

- Three different cards available to serve all regions

- No fee for obtaining the card, just pay for delivery

Paycent Cons

- Fees can add up quickly when the card is used often

- KYC fee is hard to explain

- Moving money around for loading the card can seem complex to the new user